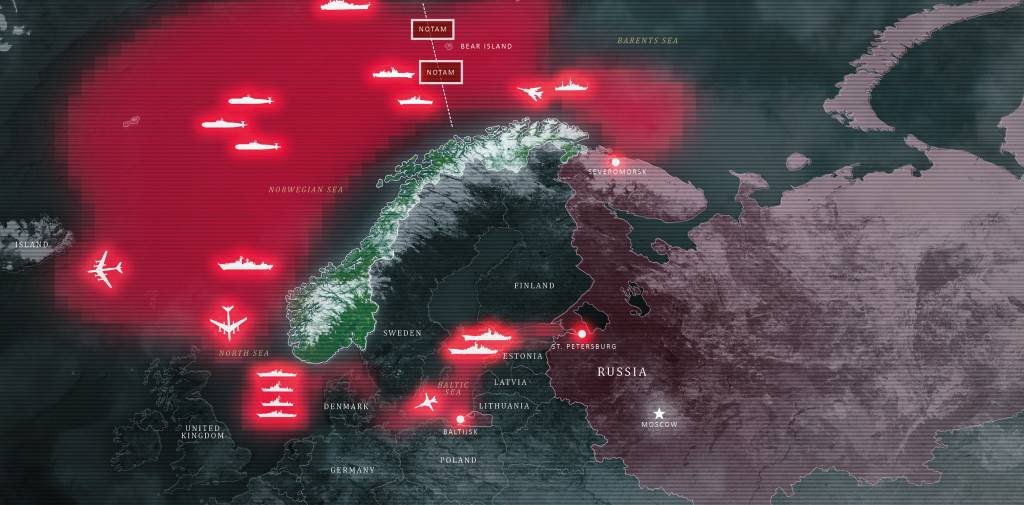

Combat power retained near Norwegian borders

As Russia’s conventional military capability has been reduced, the significance of its strategic deterrence forces has increased. The Northern Fleet’s capabilities and proximity to NATO’s core areas make it central to Russian deterrence. As a result, NATO’s northern maritime flank has become more significant.

Whereas Northern Fleet land forces have been reduced by around 80 per cent, its naval forces have been little affected by the war in Ukraine and continue to receive new submarines and surface vessels. The Northern Fleet remains the greatest military threat to Norway. The Fleet’s vessels can threaten NATO supply lines and strategic targets, and the submarines are capable of attacking targets across Europe and the United States. The air forces on the Kola Peninsula have been affected to some extent by the war, resulting in a reduced presence of tactical bombers and strategic air defences.

After Russian bases further south were attacked by Ukrainian forces, Russia has temporarily relocated many strategic bombers to the Kola Peninsula. The aircraft are used in the war in Ukraine, and their deployment north is expected to continue.

The Northern Fleet’s deep-water capabilities continue to pose a serious threat to Western underwater infrastructure. The Russian underwater reconnaissance programme (RURP) has sophisticated surface vessels, submarines and other capabilities for mapping, reconnaissance and sabotage of civilian communication cables and underwater installations. RURP has a considerable capacity to threaten Norwegian and Western critical underwater infrastructure and energy sectors. In addition, Russian intelligence and security services are taking advantage of a significant number of civilian vessels.

Russia will continue to develop military infrastructure in the Arctic, including airbases and military bases, radar sites and coastal defence installations. Nevertheless, the war in Ukraine and a struggling economy leaves limited resources, and the work will take longer than originally planned.

Testing of new Russian weapons systems will also continue in the High North. Further testing of intercontinental ballistic missiles, long-range precision-guided weapons, hypersonic missiles and anti-satellite weapons is expected.

Weapons designed for nuclear propulsion, both missiles and torpedoes, were tested at Novaya Zemlya in 2023, and this activity is expected to continue. The testing carries a risk of accidents and local radioactive emissions.